Member Investment Choice (MIC) gives members the opportunity to invest their superannuation in one or more of the eight investment options offered by Australian Food Super. If you don’t make an investment choice, your super will be invested in our default MySuper product.

The investment options are identical for Australian Food Super and the Australian Food Pension, except for the MySuper option is not available in the Australian Food Pension.

Please refer to the Investment Guide for more details of these investment options.

Please note: The former Shares option failed the 2023 APRA performance test (more info available here). This option has been closed effective 27 May 2024.

Your choice of options

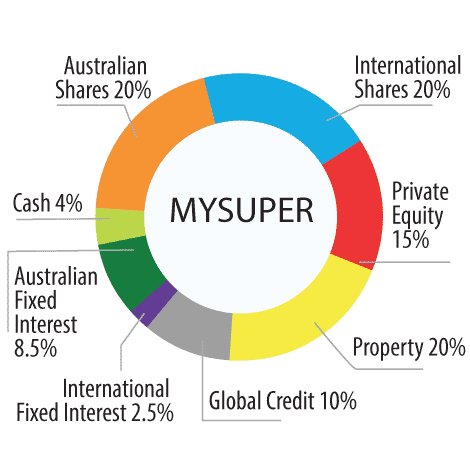

MySuper Option

This is the default investment strategy used by Australian Food Super if you don’t choose how you wish to have your superannuation invested. The MySuper Option provides a diversified mix of investments, which attempts to provide a balance between risk and return. It is estimated that the probability of a negative return on average is 3.9 out of every twenty years.

NOTE: The MySuper Option is not available in Australian Food Super Pension.

Secure Option

The Secure Option provides investment in domestic cash. This is the lowest risk strategy available to Australian Food Super members and there is little likelihood that this option will provide a negative return. Whilst this option is designed to consistently provide a positive return on investment, long-term investment may result in a low accumulation of retirement savings.

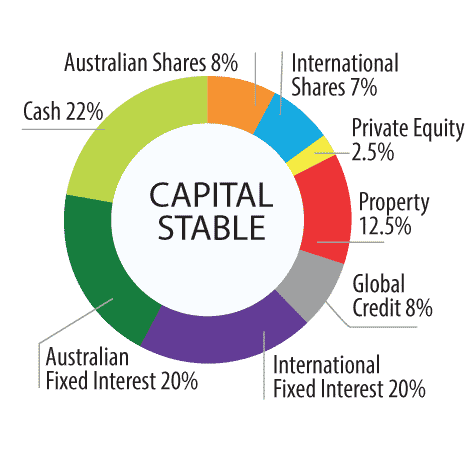

Capital Stable Option

The Capital Stable Option is designed for members who want to target returns that are better than Cash, with a lower risk than the Balanced Fund. It is estimated that the probability of a negative return on average is 1.9 out of every twenty years.

The assets held in this option will be diversified with some small exposure to Australian and Overseas shares. However the majority of the investment will be in Fixed Interest and cash. Fixed Interest investments are things like Government or Corporate Bonds. The risk profile is greater than the Secure Option, but less than the Balanced Option.

Property Option

The Property investment option consists of Australian unlisted property. It is estimated that the probability of a negative return is 4.8 out of every 20 years.

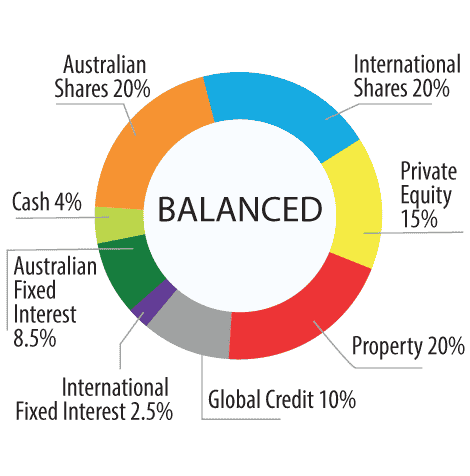

Balanced Option

The Balanced Option provides a diversified mix of investments, which attempts to provide a balance between risk and return. It is estimated that the probability of a negative return on average is a 3.9 out of every twenty years.

Growth Option

The Growth Option provides investment mainly in Australian and international shares and alternatives such as infrastructure and private equity. Returns may vary significantly from year to year. There is a higher probability of negative returns than the Balanced Option with an estimated probability of a negative return on average 4.6 out of every twenty years.

Australian Shares Option

The Australian Shares option is designed to achieve returns of inflation plus 5% p.a. over rolling 10 year periods with 100% of assets invested in Australian shares. The risk profiles is very high and it is estimated that the probability of a negative return is 6.6 out of every 20 years.

International Shares Option

The International Shares option is designed to achieve returns of inflation plus 5% p.a. over rolling 10 year periods with 100% of assets invested in international shares. The risk profiles is very high and it is estimated that the probability of a negative return is 6.3 out of every 20 years.

Alternatives Option

The Alternatives option invests in private equity. It is estimated that the probability of a negative return is 4.2 out of every 20 years.

Switching

How do I switch between investments?

You can switch online or by filling in a form.

We recommend that you register for MemberAccess which will allow you to request an investment switch instantly online. For more details you can contact the Member Hotline on 1800 808 614.

Online: If you’re already registered to MemberAccess, you’ll be able to make switches online. If not, you can register online by clicking on the ‘Register now’ button in MemberAccess.

Form: For members still working, fill in the form on page 11 of the Investment Guide and post it back to us. Pension members can switch using the Pension member investment choice form.

When does my switch take effect?

Investment switches can be made weekly and take effect from the next Wednesday. If you complete a Member Investment Choice Form, it must be received by Australian Food Super’s Administrator by Tuesday to take effect from the following day. If switching online, the switch must be updated by 11:59 pm on the Tuesday.

Please note that our Administrator does not receive mail deliveries on weekend or Public Holidays in NSW; therefore if using the form to make a switch you need to allow time for the form to be processed by Australia Post.

How much does it cost?

There is no charge to make a switch.

How often can I switch?

If you make more than one switch application in a week, the last one received will be the one processed to your account.

Example:

| Application received between: | Takes effect from: |

|---|---|

| Wed 3 May 2023 and Tues 9 May 2023 | Wed 10 May 2023 |

| Wed 10 May 2023 and Tues 16 May 2023 | Wed 17 May 2023 |

| Wed 17 May 2023 and Tues 23 May 2023 | Wed 24 May 2023 |

Please refer to the Australian Food Super Investment Guide for further details about switching.

Current balance invested one way / future contributions invested another

The way you want your super invested is your choice. You can decide to invest your current balance and all new contributions in one investment option or split it amongst several options. You can also decide to invest your current balance in one option and then choose another investment option or options for new contributions.

Prior to making any change to the way your superannuation is invested you should refer to the current Investment Guide which contains full details of all of the investment options offered. You can download the Investment Guide here or obtain a printed copy by calling 1800 808 614.

It is also recommended that you seek financial advice prior to making any decision regarding the investment of your super. Australian Food Super can assist you through our partnership with Retire360, who have been engaged by the Trustee to provide members with independent financial advice. Members can call between 8.30am and 6.30pm Sydney time and speak to a financial planner who can offer advice on investment options and other super related topics. This basic advice is provided at no additional cost to members – it is paid for from the fund.