The Product Dashboard below is required by law and you can use this dashboard to compare our MySuper product with other MySuper products. Go to ASIC’s MoneySmart website for more information on how to pick the right MySuper fund for you.

Return

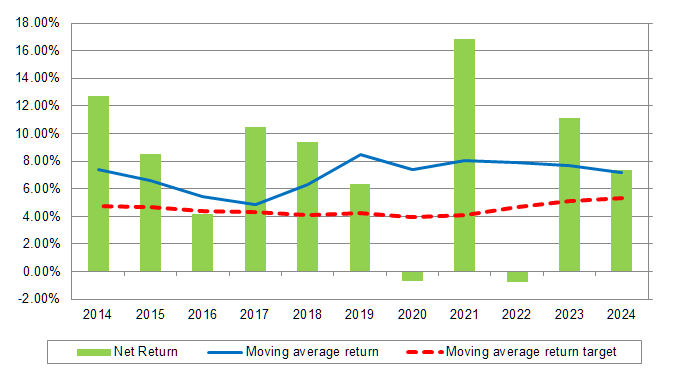

10 year average return of 7.34% as at

30 June 2024.

Returns take into account past investment history of the Australian Food Super Balanced option, being the default investment option offered in Australian Food Super prior to commencement of MySuper.

Past performance is not a reliable indicator of future performance.

Return target

Return target over rolling ten-year periods of 3% per year above inflation, after fees and taxes.

Future returns cannot be guaranteed. This is a prediction and returns ultimately achieved may be materially different from this target.

Comparison between return target and return

Level of investment risk

Medium to high

The estimated number of years of negative net investment returns is estimated to be 3.9 out of every 20 years.

The higher the expected return target, the more often you would expect a year of negative returns.

Statement of fees and other costs

$363.40 per year

Statement of fees and other costs assumes a member with a $50,000 account balance fully invested in Australian Food Super’s MySuper investment option. Also, the stated amount does not reflect all the fees and costs that may apply (e.g. activity fees and insurance fees are not included).

The information in this Product Dashboard may change from time to time.

Please refer to the Product Disclosure Statement before making any decision relating to your investment in Australian Food Super.