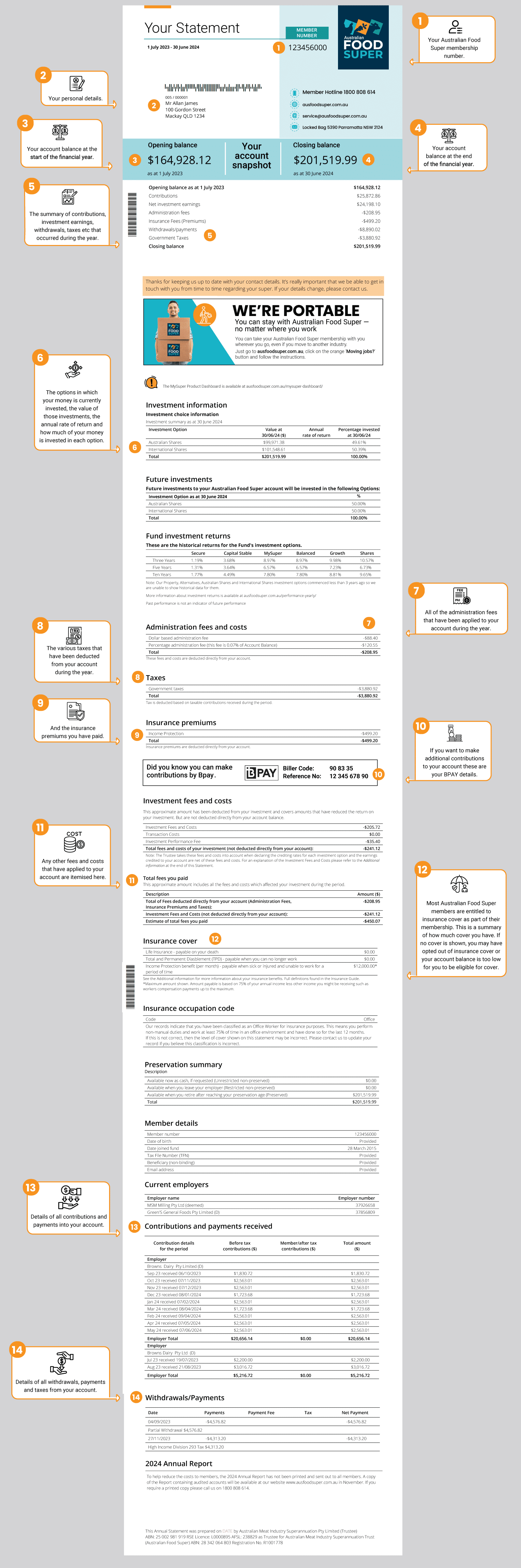

Around September/October each year, Australian Food Super issues an annual super statement to every member. This statement records all of the activity that has occurred on your superannuation account during the previous financial year. It’s an opportunity for you to review how your super has performed and where you are in terms of retirement savings.

If you joined Australian Food Super after 30 June, you’ll receive your first statement next year, but in the meantime, you can check the status of your account using MemberAccess on our website or via our mobile phone app.

So how should you use this important document?

Check your information is correct.

The first thing you should do is make sure your name is spelt correctly and that your address is correct. Also, check whether you have given us your tax file number, email address and mobile phone number. If not, you can update this information using our member app or by calling us on 1800 808 614.

Have you nominated any beneficiaries?

You might want to check who you have nominated to receive your superannuation and any insurance benefits in the event of your death. Refer to our Death Benefit Claim Fact Sheet for more information, noting that we do not have binding nominations.

You can also change your beneficiary nomination using our member app or by calling us on 1800 808 614.

Check contributions.

From 1 July 2025, employer compulsory contributions to super rose to 12%. You should check your contribution transactions to ensure you have received all the super you’re entitled to. Your statement will also show any personal contributions you may have made during the year.

Fees and costs.

Your statement will also show you the fees you have been charged and what they are for. You can find out more about the fees and costs associated with super here.

Investment performance.

Another important feature of your statement is the information on your investments. Your statement shows the short- and long-term performance of our investment options as well as how much money you have invested and in which options.

If you would like to discuss how your super is invested, just call our Member Hotline on 1800 808 614 and ask to speak to one of our financial advisors.

Insurance cover.

All Australian Food Super members under the age of 70 can access insurance cover through their superannuation membership.

Three types of insurance cover are available through your Australian Food Super membership:

- Life cover – a lump sum amount is paid to your beneficiaries when you die.

- Total and Permanent Disability (TPD) cover – a lump sum benefit is paid if it is determined that you have been totally and permanently disabled and are unable to work in any occupation.

- Income Protection (IP) cover – if you are injured or become sick and are unable to work in your current occupation, up to 75% of your income is paid for up to 2 years. It is important to note that IP benefits may be reduced by other income you receive, e.g. workcover payments.

Your annual statement will show what kind of cover you had as at 30 June. But this may change between then and when you receive your statement, so make sure you regularly check your cover through either our mobile app or MemberAccess on our website.

If you think you may not currently have the right level of cover, call our Member Hotline on 1800 808 614 and ask to speak to one of our financial advisers.